China’s Solar Surge Is Making a Missing Power Data Problem Worse

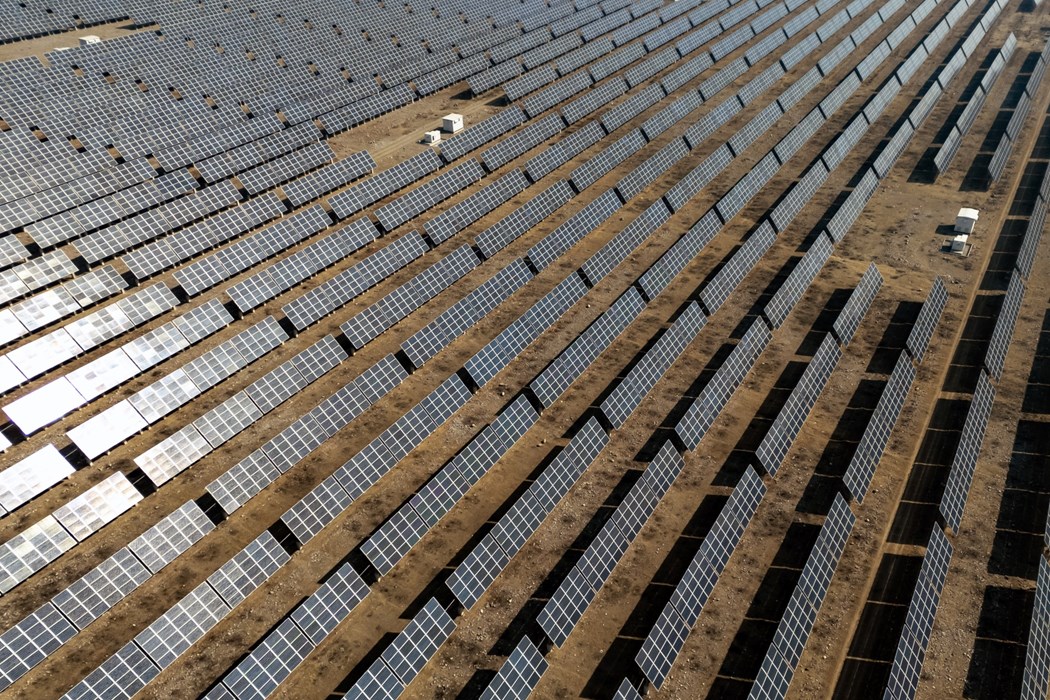

(Bloomberg) -- The boom in renewable energy installations in China is exacerbating a problem measuring power production data in the world’s second largest economy.

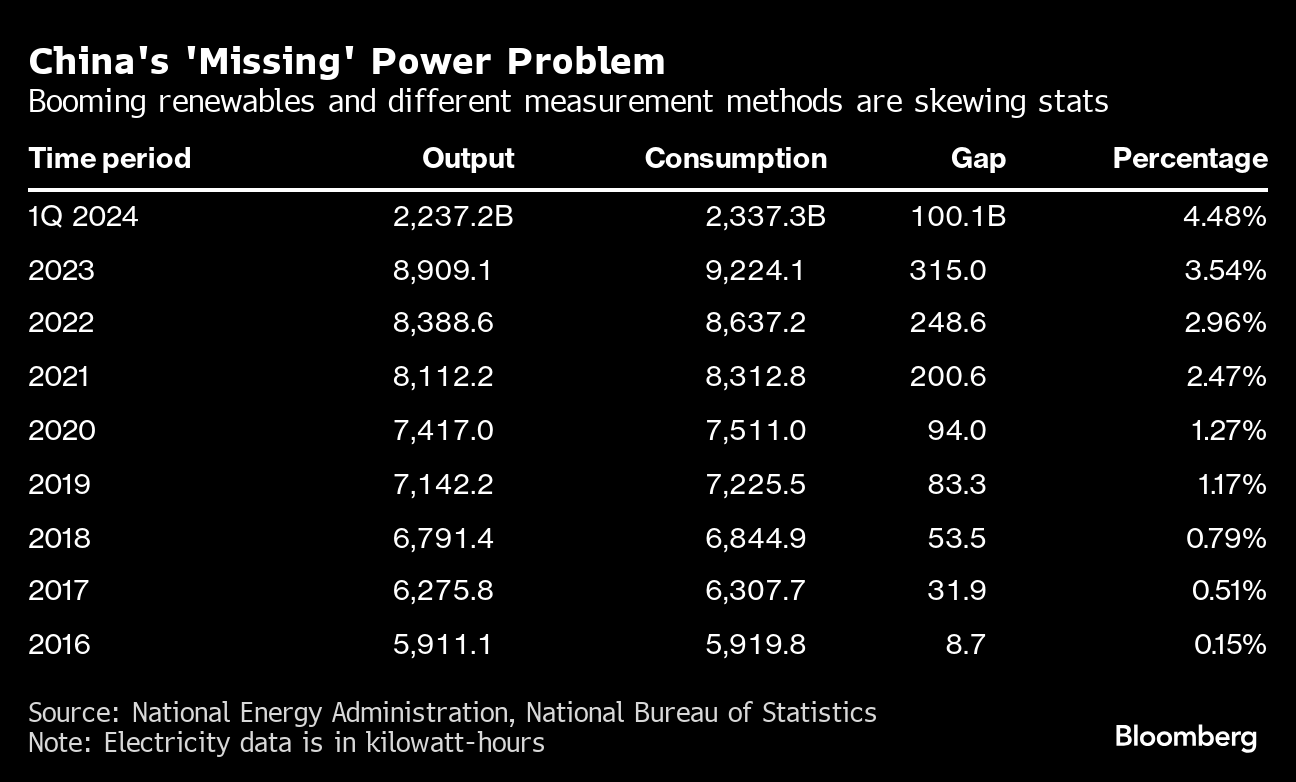

The gap between electricity consumption, as measured by the National Energy Administration, and power production calculated by the National Bureau of Statistics grew to 46.5 billion kilowatt-hours in March. That means 6.2% of power generation was missing from monthly output statistics that investors and policymakers use to assess important economic growth factors like gross domestic product.

The issue is that consumption data covers the entire country, but output data is only measured at facilities deemed large enough to matter to the economy. While that made sense in an era of massive coal-fired power plants located in or near urban centers, it’s been upended by the breakneck growth in wind and solar projects, many of which are housed in arrays that don’t meet the government’s threshold.

Then there’s the rapid uptake in rooftop solar, which covers houses and businesses and even farms across the country and isn’t counted.

And so the gap widens. In 2023, it amounted to 3.5% of total generation, up from less than 1% in 2018. Although electricity production accounts for a relatively small portion of the economy, the discrepancy is only likely to get bigger as China installs more clean energy. That could lead to underestimations in how much the economy is growing.

Generation from smaller plants does eventually get counted in annual statistical yearbooks, but those are published long after the monthly output data. In the meantime, analysts would be well served by being wary of monthly electricity production figures.

On the Wire

New sanctions on Iranian oil were included as part of a foreign aid package released by House Republicans Wednesday that is slated for a floor vote later this week.

BHP Group Ltd.’s iron ore production rose 3% in the year’s first three months, as the world’s biggest miner shrugged off heavy rainfall at its Western Australia projects along with dwindling demand in China.

President Biden’s call for higher tariffs on Chinese steel and aluminum — and his announcement of a formal probe into China’s shipbuilding industry — are likely to have limited near-term impact on these industries and on US-China relations, according to Bloomberg Economics.

The boss of Europe’s biggest copper company has accused his Chinese rivals of operating uneconomically and called on Western nations to take action to protect their own industries.

The Week’s Diary

Thursday, Thursday April 18:

- China’s 2nd batch of March trade data, including agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

- China March output data for base metals and oil products

- Oil conference in Chongqing hosted by OilChem and CPCA

- EARNINGS: Eve Energy

Friday, April 19:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Huayou Cobalt, Gotion

Saturday, April 20

- China’s 3rd batch of March trade data, including country breakdowns for energy and commodities

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Rising Copper Demand Spurs Search for Alternative Climate Solutions

Apr 26, 2024

US commits $100 million to preparing the grid for a net-zero economy

Apr 26, 2024

Honda to Spend $11 Billion on Electric Vehicle Strategy in Canada

Apr 25, 2024

Biden Curbs on Power Plant Pollution Collide With Demand

Apr 25, 2024

South Korea’s Top Steelmaker Rethinks Battery Metal Investments

Apr 25, 2024

Korea Solar Maker Qcells to Shut Down Production in China

Apr 25, 2024

US Solar Makers Seek Additional Tariffs on Panel Imports From Asia

Apr 24, 2024

Enel Forced to Raise Coupons on $11 Billion of ESG Bonds

Apr 23, 2024

SunPower Slides After Disclosing Plans to Restate Earnings

Apr 23, 2024

AFC Joins $20 Billion Morocco-to-UK Subsea Power Export Project

Apr 22, 2024

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Mar 11, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum